Rajkotupdates.news : The Government Has Made A Big Announcement Regarding the interest rate

Stay informed about the government’s major announcement on interest rates, covered on rajkotupdates.news. Discover how these changes could impact your loans, savings, and overall financial planning, and what steps you should take next.

What is the New Interest Rate?

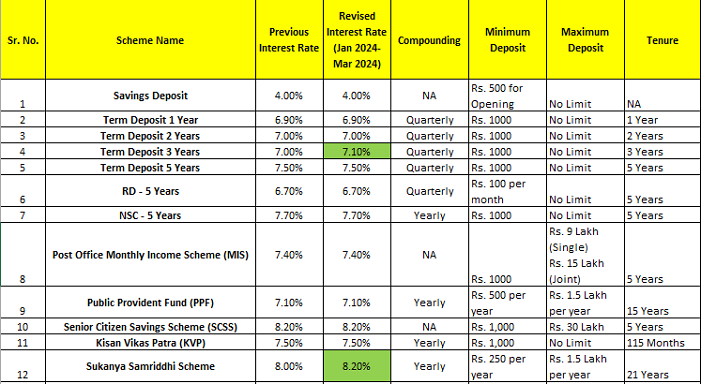

The government has revised the interest rates, which are crucial for various financial products like loans, savings accounts, and fixed deposits. The change is part of a broader strategy to manage the economy more effectively, particularly in response to inflationary pressures and market conditions.

How Will This Impact Borrowers?

For those with existing loans, the new interest rate could mean changes in your monthly payments. If the rate has increased, expect higher EMIs (Equated Monthly Installments). On the other hand, if the rate has decreased, you might see some relief in your repayment schedule. This is especially relevant for those with home loans, personal loans, and car loans, where even a small percentage change can have a substantial impact.

What About Savers and Investors?

If you have money parked in savings accounts or fixed deposits, the new interest rate could affect the returns on your investments. A higher rate might mean better returns, while a lower rate could reduce the interest earned on your savings. For investors in government bonds and other fixed-income securities, this change will also alter the expected yields.

Why Did the Government Make This Change?

The adjustment in interest rates is typically driven by economic factors like inflation, currency value, and overall economic growth. The government aims to strike a balance between encouraging spending and controlling inflation. By adjusting the interest rates, they hope to either stimulate borrowing and investment or curb excessive growth that could lead to inflation.

What Should You Do Next?

- Review Your Loans: Check the terms of your loans and see how the new rate affects your repayments. Consider refinancing if it could lead to better terms.

- Evaluate Your Savings: Look at your savings and investment portfolios to determine if you need to make any adjustments based on the new rates.

- Stay Informed: Keep an eye on further announcements from the government or the central bank, as more changes could be on the horizon.

Conclusion

The government’s recent announcement on interest rates is a critical development that could influence many aspects of your financial life. Whether you’re repaying a loan or planning your savings strategy, it’s essential to understand how these changes will impact you. Stay proactive, review your financial situation, and make informed decisions to navigate this new landscape effectively.